Selling on Myntra should be simple list products, set prices, join sales, get orders.

Reality tells a different story.

Despite Myntra hosting over 50 million monthly active users and India’s fashion e-commerce crossing ₹80,000 crore, most sellers struggle with a frustrating paradox: traffic exists, but sales don’t follow.

The complaints echo across seller communities:

“We’re visible but conversions are terrible.”

“Competitors with similar products get 5× our orders.”

“Every sale feels like burning money on discounts.”

The general perception is straightforward lower prices + deeper discounts + more ads = more sales. This logic sounds right. It’s also dangerously incomplete.

Myntra isn’t a passive marketplace where customers simply find the cheapest option and buy. It’s an algorithm-driven ecosystem where visibility, catalog quality, timing, and strategic execution determine which products get seen, considered, and purchased. Two sellers can offer identical products at identical prices one thrives while the other struggles with single-digit daily orders.

The difference isn’t luck. It’s avoiding specific, identifiable mistakes that most sellers unknowingly make.

This guide will walk through:

Before diving into mistakes and strategies, understanding how Myntra’s ecosystem operates is essential.

| Factor | What It Means |

| Catalog Health | Product listing quality (images, titles, descriptions, attributes) directly impacts search rankings and recommendation visibility |

| Commercial Competitiveness | Discount depth, coupon participation, and pricing relative to competition influence algorithmic placement |

| Operational Excellence | SLA adherence, cancellation rates, return rates, and delivery speed affect seller score and campaign eligibility |

| Sales Velocity | Consistent order flow improves organic rankings more than sporadic spikes |

| Threshold | Number | Why It Matters |

| Ad Spend History | ₹50,000+ over 90 days | Myntra’s keyword targeting algorithm requires data to optimize. Below this threshold, ad efficiency is significantly lower |

| Monthly Order Volume | 200-500 orders | Crossing this unlocks SJIT (Seller Just-in-Time) eligibility faster delivery badges, improved search visibility, premium campaign placement |

| Pre-Sale Window | 10-15 days before major sales | This is when significant campaign revenue is decided. Customers load carts during this period; brands that capture this attention win before the sale begins |

Flawed belief: “Better discount = More sales”

Reality: “Visibility × Competitive discount = Sales”

During major sales, thousands of products compete for attention. A product with moderate discount but high visibility will consistently outsell a product with deep discount but low visibility.

Strategic planning requires understanding the full promotional calendar. Below is the comprehensive Myntra sale schedule for 2026.

| Event | Expected Dates | Priority Level | Key Categories |

| Myntra New Year Sale | January 1-5 | Medium | Accessories, Casual Wear, Beauty |

| Myntra Republic Day Sale | January 20-25 | High | Winter Wear, Ethnic Fusion, Footwear |

| Myntra Valentine’s Week Sale | January 30- Feb 08 | Medium-High | Couple Wear, Accessories, Fragrances, Lingerie |

| Myntra Women’s Day Sale | March 6-8 | Medium | Women’s Western, Ethnic, Beauty |

| Myntra Holi Sale | March 12-15 | Medium | Ethnic Wear, Casual Wear, Kids |

| Event | Expected Dates | Priority Level | Key Categories |

| Myntra Summer Fashion Sale | April 15-22 | High | Summer Wear, Sunglasses, Footwear, Swimwear |

| Myntra Big Fashion Days | May 8-12 | High | All Categories |

| Myntra Wedding Season Sale | May 20-30 | High | Ethnic Wear, Jewelry, Sherwanis, Sarees |

| Myntra End of Reason Sale (EORS) | June 20 – July 5 | Critical | All Categories — Biggest sale of the year |

| Event | Expected Dates | Priority Level | Key Categories |

| Myntra Monsoon Sale | July 18-25 | Medium | Rain Wear, Footwear, Casual Wear |

| Myntra Raksha Bandhan Sale | August 5-9 | Medium-High | Ethnic Wear, Accessories, Gift Sets |

| Myntra Independence Day Sale | August 12-16 | High | All Categories |

| Myntra Big Fashion Days | September 12-16 | High | All Categories |

| Event | Expected Dates | Priority Level | Key Categories |

| Myntra Navratri & Dussehra Sale | September 28 – October 5 | High | Ethnic Wear, Chaniya Choli, Jewelry |

| Myntra Diwali Sale | October 15-25 | Critical | Ethnic Wear, Jewelry, Home, Gifting |

| Myntra Black Friday | November 20-24 | High | All Categories |

| Myntra End of Reason Sale (EORS) | December 4-12 | Critical | All Categories |

| Tier | Events | Resource Commitment |

| Tier 1: Full Commitment | EORS (June & December), Diwali Sale, Big Fashion Days | Maximum inventory, ad spend, team bandwidth |

| Tier 2: Strategic Participation | Republic Day, Independence Day, Pink Friday, Wedding Season | Focused SKU participation; selective investment |

| Tier 3: Tactical/Testing | Valentine’s, Holi, Monsoon, Women’s Day | Category-specific; clearance focus; testing ground |

Here’s the comprehensive breakdown of mistakes that separate profitable sellers from those who struggle and the fixes that work.

The Problem:

Many sellers assume that participating in more campaigns automatically leads to more sales. They register for every Myntra event Republic Day, Valentine’s, Holi, Summer Sale, EORS, Diwali, Pink Friday spreading resources across 15+ promotions annually.

What Actually Happens:

The Fix:

Create a Campaign Portfolio Strategy:

Not every sale deserves equal attention. Classify events into tiers and allocate resources accordingly:

| Tier | Approach | Inventory Focus |

| Tier 1 | Full participation with maximum effort | Hero SKUs + Volume drivers + Clearance |

| Tier 2 | Selective participation | Hero SKUs only |

| Tier 3 | Clearance and testing only | Dead stock + New product tests |

Reserve hero products for Tier 1 events: The top 10-15% of products driving majority of revenue should only be heavily promoted during EORS and major Big Fashion Days events.

Use Tier 3 events as test labs: Before committing heavily to EORS, use smaller sales to test discount elasticity, creative formats, and build ad spend history.

The Problem:

Inventory planning mistakes cause maximum financial damage on Myntra. The pattern is predictable:

Understocking Scenario:

Overstocking Scenario:

The Fix:

Implement category-specific demand forecasting:

Different categories behave differently during various sales:

| Category | EORS Behavior | Diwali Behavior |

| Ethnic Wear | 3-4× normal | 6-8× normal |

| Western Casualwear | 5-6× normal | 2-3× normal |

| Footwear | 4-5× normal | 3-4× normal |

| Accessories | 3-4× normal | 5-6× normal |

Create tiered inventory strategy:

| Product Tier | Definition | Stock Strategy |

| Hero SKUs | Top 10-15% driving 60-70% of revenue | 2.5-3× normal inventory |

| Volume Drivers | Consistent mid-tier performers | 2× normal inventory |

| Clearance | Slow-movers, previous season | Clear at minimal margins |

Phase inventory release:

Don’t make all stock available at sale launch. Release in tranches across the sale duration to maintain “In Stock” status throughout:

Build toward SJIT eligibility:

Sellers achieving 200 to 500 monthly orders become eligible for SJIT (Seller Just in Time) program, unlocking faster delivery badges, improved search visibility, and better campaign placement.

The Problem:

The pressure to match competitor discounts leads many sellers to slash prices across their entire catalog including flagship products.

Short-term: Order spike

Long-term consequences:

The Fix:

Implement strategic discount architecture:

| Product Category | Discount on MRP | Coupon Layer | Margin Target |

| Hero/Flagship Products | 30-40% off | None or 5% | 18-22% |

| Volume Drivers | 50-60% off | 10% of selling price | 12-15% |

| Clearance/Previous Season | 70-80% off | 10-15% of selling price | 0-5% (breakeven acceptable) |

| Dead Stock | 80-90% off | Maximum available | Negative acceptable |

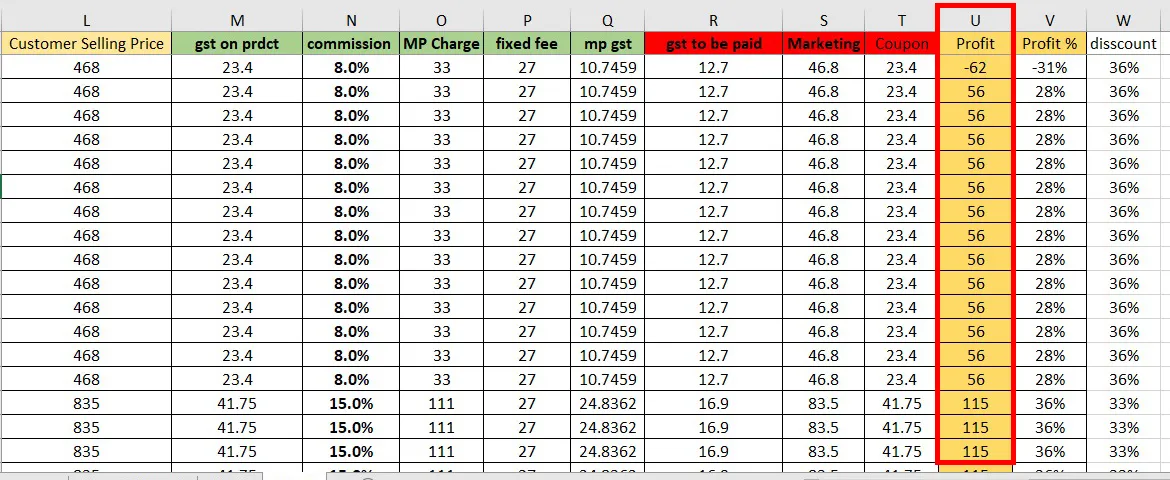

Understand the MRP-Selling Price-Coupon stack:

Myntra’s visibility algorithms reward coupon participation. Optimal structure:

Example Calculation:

| Component | Hero SKU | Clearance SKU |

| Product Cost | ₹400 | ₹400 |

| MRP | ₹1,999 | ₹1,999 |

| Selling Price | ₹1,199 (40% off) | ₹499 (75% off) |

| Coupon | ₹120 (10%) | ₹75 (15%) |

| Customer Pays | ₹1,079 | ₹424 |

| Bank Settlement Amount | ~₹850 | ~₹335 |

| Margin | ₹450 (healthy) | -₹65 (acceptable loss) |

Use BOGO strategy to protect hero pricing:

Instead of discounting a flagship ₹1,500 shirt to ₹600:

Offer: “Buy this shirt at ₹1,100 + get matching trousers at ₹399 (worth ₹999)”

Benefits:

The Problem:

During major sales, thousands of products compete for attention. The customer journey flows through:

At every stage, visibility precedes consideration. A product with moderate discount and high visibility will outsell a product with deep discount and low visibility.

The Fix:

Build ad history before major events:

Myntra’s ad platform leverages machine learning that improves with data. Keyword targeting delivers significantly better results when ad spend crosses ₹50,000 in the preceding 90 days.

Don’t wait for major sales to start advertising. Build ad history 2-3 months in advance so the algorithm is optimized when it matters most.

Master the Add to Cart pre sale strategy:

This is one of the most powerful tactics that successful sellers employ.

How it works:

Starting 10-15 days before major sales, customers begin browsing, comparing, and adding products to their carts in anticipation.

Winning approach:

Why this works:

The conversion battle is largely decided in the pre-sale window. Customers who have already added a product to their cart are unlikely to remove it once the sale begins—they’ve mentally committed to the purchase.

Allocate visibility budget strategically:

| Phase | Budget Allocation | Focus |

| Pre-Sale (D-15 to D-1) | 40% of campaign budget | Cart loading; brand visibility |

| Sale Days 1-2 | 35% of campaign budget | Conversion; hero SKU push |

| Remaining Sale Days | 25% of campaign budget | Retargeting; clearance push |

The Problem:

Product listings are the storefront on Myntra. Low-quality visuals, generic titles, and incomplete attributes create friction at the most critical moment. when customers are deciding whether to click, consider, and convert.

Common catalog issues:

Result: High ad spend, low conversion rates, wasted investment.

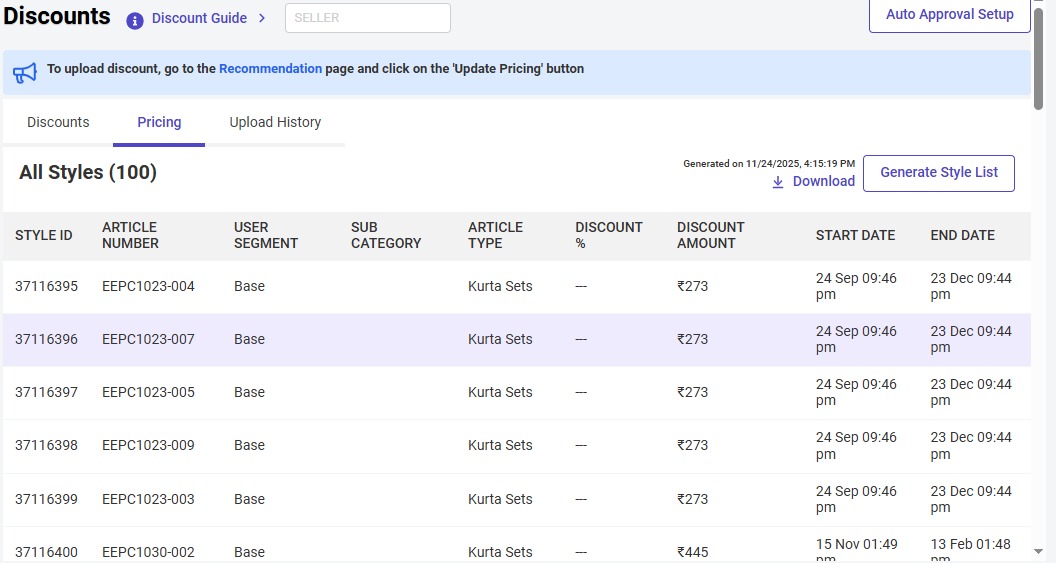

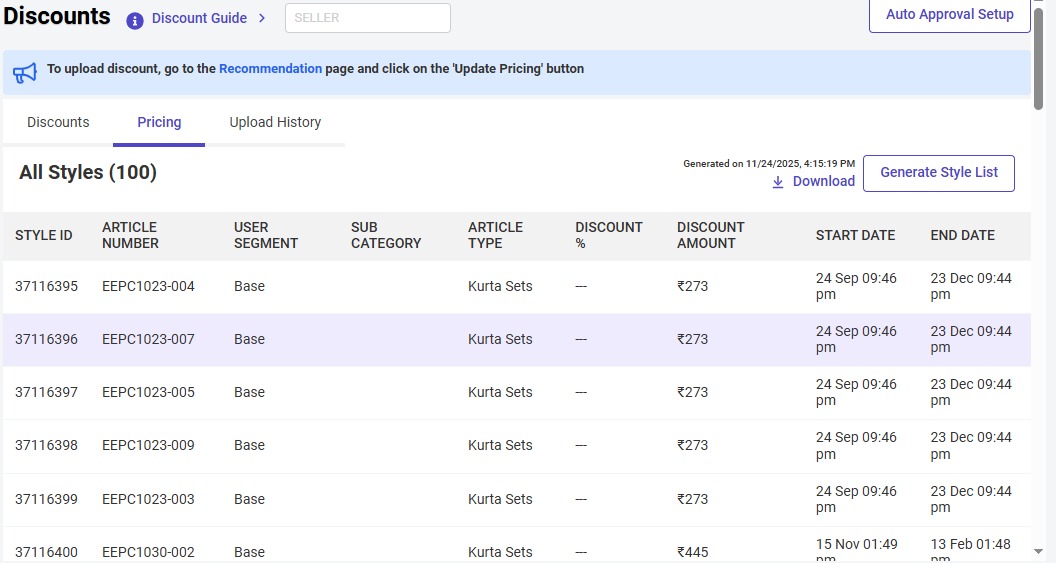

Myntra’s algorithm increasingly weights catalog health scores, a composite of image quality, title optimization, attribute completeness, and description quality.

The Fix:

Image optimization standards:

| Image Type | Best Practice |

| Primary Image | Pure white background; full product visibility; minimum 1080×1440px |

| Secondary Images (4-6) | Lifestyle shots; multiple angles; fabric close-ups; size reference |

| Campaign-Specific | Refresh for major events with seasonal themes |

Title optimization formula:

Before: “Women Kurta Blue”

After: “Women’s Embroidered Cotton A-Line Kurta | Navy Blue | Festive & Casual Wear | [Brand Name]”

Structure:

text

[Gender] + [Product Type] + [Key Feature/Fabric] + [Style] + [Color] + [Occasion] + [Brand]

Complete all catalog attributes:

Products with 100% attribute completion rank higher and appear in more filtered searches:

Conduct pre-sale catalog audits:

Review and optimize listings 30 days before every Tier 1 event flag poor images, optimize titles, complete missing attributes.

The Problem:

Many sellers configure campaign settings inventory, discounts, ads before the sale begins, then step away assuming nothing can be adjusted mid-event.

Consequences:

The Fix:

Treat major campaigns as live operations:

Assign dedicated team members to monitor performance in real time during sale events.

Implement optimization protocol:

| Timeframe | Action |

| Hours 1 to 6 | Monitor initial velocity; identify early winners and losers |

| Hours 6 to 24 | First optimization: Pause underperforming ads; increase budget on high-converters |

| Hours 24 to 48 | Analyze cart vs. conversion data; adjust pricing on high abandonment SKUs |

| Days 3 to 5 | Push clearance inventory with additional coupon incentives |

| Final Days | Last-chance messaging; clear remaining promoted inventory |

Leverage Add-to-Cart data:

Myntra provides Add-to-Cart analytics (typically with 15-20 day lag). Use this data to inform strategy:

| Performance Pattern | Strategy |

| Top Selling SKUs | Increase ad budget by 2×; consider slight margin reduction (20% → 15-17%) to accelerate volume |

| Low Selling SKUs | Push for break-even sales; clear at zero margin to free capital |

| High Cart, Low Conversion | Indicates pricing friction—add flash coupon or bundle offer |

The idea behind margin compression on top sellers: Focus on increasing number of orders rather than maximizing margin per order. Volume creates momentum, improves rankings, and builds long-term visibility.

The Problem:

The sale ends. Orders are fulfilled. Teams exhale.

Then… nothing.

Most brands fail to recognize that campaign buyers represent a concentrated cohort of high-intent customers who can drive:

Cost of ignoring post-sale engagement:

The Fix:

Segment campaign buyers within 72 hours:

| Segment | Criteria | Strategy |

| High-Value New Customers | First purchase; AOV above average | Premium nurture; exclusive early access to new arrivals |

| Repeat Buyers | Purchased before; returned for sale | Loyalty program enrollment; VIP treatment |

| Single-Item Buyers | Low AOV; single category | Cross-sell campaigns; “Complete your look” offers |

Execute 30-day post-sale nurture sequence:

| Timing | Communication | Objective |

| Day 3-5 | Delivery confirmation + “Complete Your Look” suggestions | Immediate cross-sell |

| Day 10-14 | “Thank You” message + exclusive loyalty coupon (15% off next purchase) | Drive repeat visit |

| Day 21-25 | New arrivals showcase (non-sale items) | Full-price consideration |

| Day 28-30 | “We Miss You” reminder + time-limited offer | Urgency-driven conversion |

Implement BOGO cross-sell strategy:

Example: Customer purchases formal shirt during sale.

Day 5 Communication: “Your shirt is on its way! Complete your look add matching trousers at 25% off (exclusive for sale buyers).”

Benefits:

The Problem:

Myntra campaigns come with detailed requirements:

Sellers treating these as formalities face consequences:

The Fix:

Assign campaign compliance ownership:

Designate a team member responsible for reading, understanding, and ensuring adherence to all campaign documentation.

Build a compliance timeline:

| Days Before Event | Action |

| D-30 | Review campaign announcement; note all requirements |

| D-21 | Confirm inventory commitment internally |

| D-14 | Submit inventory commitment to Myntra |

| D-10 | Configure discounts and coupons accurately |

| D-7 | Submit creative assets (if required) |

| D-3 | Verify all configurations live correctly on platform |

| D-1 | Final compliance audit; confirm team readiness |

Maintain SLA readiness:

Myntra penalizes sellers who fail SLA during high-volume events:

Pre-sale actions: Confirm logistics partner capacity, pre-pack bestselling SKUs, staff adequately for dispatch surge.

Beyond avoiding mistakes, here are proactive strategies that drive consistent growth.

The Insight:

Every brand accumulates dead stock inventory that hasn’t moved in 3-6+ months, blocking capital and warehouse space.

Most sellers hold onto this inventory hoping for eventual recovery. This approach almost always backfires.

The Strategy:

The Logic:

It’s acceptable even smart to sell dead stock at 10-20% loss from base cost. The idea is to free blocked capital and reinvest in products that are actually selling. The loss on clearance gets recovered through margins on top performers.

The Insight:

A significant portion of sale revenue comes from carts loaded in the 10-15 days before the event begins.

The Execution:

| Phase | Timing | Action |

| Awareness | D-15 to D-10 | Increase brand search bids; refresh hero images with “Coming Soon” messaging |

| Consideration | D-10 to D-5 | Push specific product ads; target customers who viewed but didn’t purchase in previous 30 days |

| Cart Loading | D-5 to D-1 | Maximum ad allocation; retarget all visitors; “Add to cart—sale starts soon” messaging |

| Conversion | Sale launch | Maintain visibility on carted products; shift budget to non-carted high-potential SKUs |

Why this works:

Customers who’ve added products to cart before the sale are committed. They convert within hours of sale launch often before competitors’ products gain traction.

The Insight:

SJIT (Seller Just in Time) eligibility requiring 200-500 monthly orders unlocks significant visibility advantages:

The Approach:

For sellers below this threshold, create a focused plan to cross it:

The Insight:

During high traffic campaigns, slightly compressing margins on top selling SKUs can dramatically accelerate order volume improving search rankings, seller score, and long term visibility.

The Approach:

For products already performing well during a sale:

When to use this:

Strategy & Planning

Inventory & Pricing

Catalog & Creative

Advertising & Visibility

Compliance & Operations

Understanding these mistakes and strategies is the first step. Implementation is what creates results.

For sellers preparing for upcoming Myntra events:

The brands that consistently win on Myntra aren’t necessarily those with the deepest discounts or biggest budgets. They’re the ones who treat campaigns as strategic operations planned, executed, optimized, and learned from.

Every sale is an opportunity. Every mistake is a lesson. Every improvement compounds over time.

Global Websters helps fashion and lifestyle brands unlock profitable growth on Myntra, Amazon, Flipkart, and other marketplaces.

From catalog optimization to campaign strategy to performance marketing, the team brings deep expertise and proven frameworks to every engagement.