Let me start with something you’ve probably felt yourself:

“Sales toh aa rahi hain… par profit kahan hai?”

You’re hustling day and night. Orders are coming in on Amazon. Flipkart dashboard shows decent numbers. Meesho pe volume chal raha hai. But when you check your bank account at month-end, the math just doesn’t add up.

Sound familiar?

I’ve worked directly with 1000+ sellers across Amazon, Flipkart, Meesho, and Myntra, and here’s what I’ve learned: most ecommerce sellers are unknowingly running their businesses at a loss.

Not because their product is bad. Not because there’s no demand.

But because they never learned how to calculate selling price on marketplace properly.

They price based on gut feeling. They look at what competitors are doing. They add some margin to their cost price and think, “Chalo, yeh theek hai.”

But marketplace pricing doesn’t work that way.

Amazon has complex fee structures. Flipkart has commission layers. Meesho has different economics altogether. Myntra has brutal return rates in fashion. And if you’re not accounting for ALL of these costs when you decide your selling price, you’re basically funding your own losses every single day.

In this guide, I’m going to show you exactly how to calculate product price on Amazon, Flipkart, Myntra, and Meesho without making a loss using the same marketplace unit economics framework that actually profitable sellers use.

No MBA jargon. Just practical math that will genuinely save your business.

Why Marketplace Pricing Is Completely Different From Regular Retail

Let’s clear this up right away.

Product pricing on Amazon Flipkart Myntra ≠ Your Cost + Some Margin

In traditional retail or your own website, you could get away with simple math:

- Product cost: ₹100

- Add 50% margin: ₹150

- Sell at ₹150

- Keep ₹50 profit

Straightforward, right?

But ecommerce pricing strategy for marketplaces is a completely different game. This logic will destroy you here.

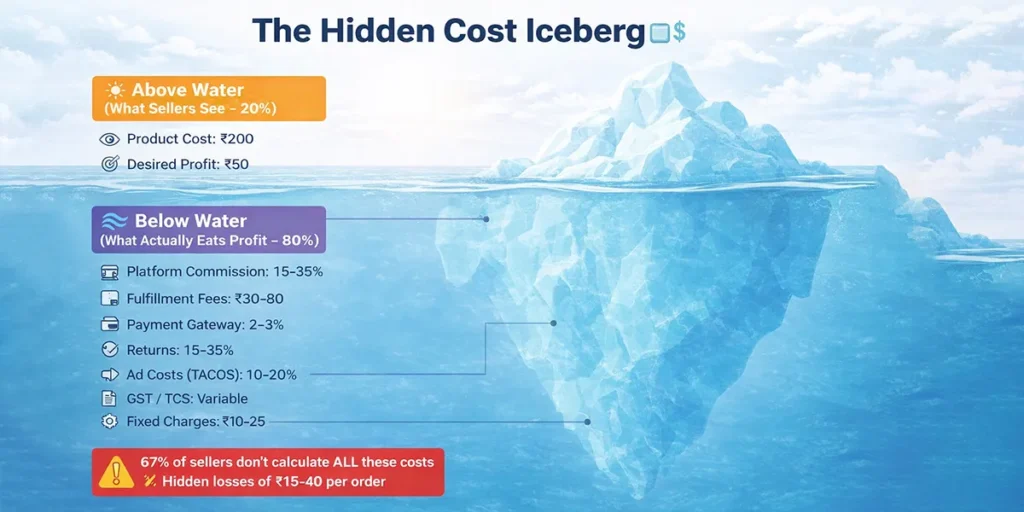

Why? Because marketplaces have hidden cost layers that eat into your margin at every single step:

- Marketplace commission: 0-25% depending on category and price point

- Logistics and fulfillment: Weight-based, size-based charges

- Fixed platform fees: Per-order charges

- Pick and pack fees: Warehouse handling costs

- Payment gateway: 2-3% on every transaction

- Total platform fees: Usually 25-38% combined

- Returns and RTO: 10-35% depending on category

- Advertising costs: 10-20% if you want any visibility

- Penalties and deductions: Wrong packaging, late dispatch, customer complaints

- GST complications: TCS, input credit mismatches

Add all of this up, and suddenly that ₹50 margin you thought you had? Gone. Completely gone.

In fact, you might be making a loss of ₹15-20 per order and not even realize it until your CA shows you the annual books.This is where unit economics for ecommerce sellers becomes critical.

What Is Unit Economics?

Unit economics sounds fancy, but it’s actually super simple:

Unit economics = Understanding if you make profit or loss on one single order

That’s it. Nothing complicated.

Not your monthly sales figure. Not your “good month vs bad month” feeling. Just: when you sell one product, after ALL costs are deducted, do you actually make money?

Here’s the basic formula for marketplace unit economics:

Unit Profit = Selling Price – (Product Cost + Platform Fees + Logistics + Returns Cost + Ad Spend + Other Costs)

If this number is positive and at least 15-20%, you’re okay. You can scale.

If it’s negative or barely positive (like ₹5-10 per order), you’re in serious trouble.

Why Unit Economics Matters More Than Monthly Revenue

Because revenue is vanity. Profit is reality.

You can do ₹10 lakh in monthly sales and still shut down in 6 months if your unit economics are broken.

I’ve personally seen this happen. Sellers doing 50-60 orders daily, getting celebrated in WhatsApp groups, posting screenshots of their “sales” and then quietly closing shop because they ran out of working capital.

Why? Because they were losing ₹12 per order and didn’t know it.

When you’re losing money on every sale, scaling just means you lose money faster. It’s like driving a car with a fuel leak — the faster you go, the quicker you run empty.That’s why before you think about scaling, you need to fix your product pricing on amazon flipkart myntra using proper unit economics.

The Real Reasons Sellers Make Losses on Marketplaces (Hard Truth Time)

Hum bahut sellers ke P&L dekh chuke hain. And the same mistakes repeat again and again:

1. They Only Look at Settlement Amount

Sellers check their bank account. Money is coming in. They think, “Achha chal raha hai.”

But they’re not breaking it down per order. They don’t know their profit calculation per order ecommerce. They just see ₹50,000 credited and feel good.

2. They Completely Ignore Returns, Ads, and Hidden Deductions

Return to origin cost ecommerce doesn’t show up clearly in your daily dashboard. Ad spends are billed separately. Small penalties and chargebacks come weeks later in some random email.

So sellers look at “orders” and think they made money. They didn’t.

3. They Never Do Proper Reconciliation

Your Amazon Seller Central shows one revenue number. Your payment settlement report shows something different. Your advertising console shows another spend figure. Your actual bank credit? Completely different.

If you’re not doing marketplace reconciliation process every single month, you genuinely have no idea what your real profit is. You’re just guessing.

4. They Don’t Know Per-SKU, Per-Order Economics

Most sellers can tell you their monthly revenue. Very few can tell you: “On this blue t-shirt SKU, I make ₹47 profit per order after everything.”

Without that number, you’re flying completely blind.

5. They Think Volume Will Magically Fix Losses

“Abhi thoda loss chal raha hai, but jab main 100 orders daily kar lunga, tab profit ho jayega.”

No. If your unit economics are negative at 10 orders, they’ll be negative at 100 orders too. You’ll just lose money 10x faster.

I’ve watched sellers go from ₹1 lakh monthly revenue with ₹8,000 profit… to ₹8 lakh monthly revenue with ₹60,000 loss.

How to Calculate Selling Price on Marketplace (Step-by-Step Pricing Formula)

Alright, enough about what’s wrong. Let’s talk about how to price products on myntra profitably — or Amazon, or Flipkart, or Meesho.

This is the exact marketplace pricing calculator logic you need to follow:

Step 1: Start With Category Average Price (Not Your Cost)

First, figure out what similar products are selling for in your category.

Maan lo you’re selling a cotton kurti. Go to Myntra, Flipkart, Amazon search for similar kurtis. What’s the typical price range? Let’s say ₹400-500. Average is around ₹450.

That’s your market baseline.

Step 2: Add Your Unique Value

Now, why should someone pick YOUR kurti?

- Better fabric quality than competitors? Add ₹50

- Unique hand-block print? Add ₹70

- Better fit or size range? Add ₹30

- Faster delivery or better packaging? Add ₹25

Total USP value = ₹175

Your target customer value = ₹450 + ₹175 = ₹625

This is what customers should feel your product is worth.

Step 3: Adjust Upward for Platform Fees (The Critical Step)

Here’s where flipkart amazon pricing mistakes sellers make happen.

Most sellers think: “My product is worth ₹625, so I’ll list it at ₹625.”

Completely wrong.

You need to account for total platform fees, which include:

- Marketplace commission (varies by category and price: 0-25%)

- Fulfillment/shipping charges

- Fixed platform fees per order

- Pick and pack charges

- Payment gateway fees (2-3%)

- Combined total: Usually 25-38% of selling price

You need to divide your target value by (1 – total platform %), not just subtract.

Why? Because these fees are calculated on the selling price itself.

Let me show you the amazon seller fees calculation logic:

Important Update for 2026: Both Amazon and Flipkart have introduced zero-commission pricing for lower-priced products:

- Amazon: 0% referral fee on products under ₹300 (extended till Dec 2025)

- Flipkart: 0% commission on products under ₹1,000 (November 2025 onwards)

This changes the math significantly for budget products!

For Products ABOVE ₹300 (Amazon) or ₹1,000 (Flipkart):

If platform fees are 35% total, and you want ₹625 to reach you after fees:

Formula: Selling Price = Target Value ÷ (1 – 0.35)

Selling Price = ₹625 ÷ 0.65 = ₹962

So you need to list at roughly ₹960-999 just to earn ₹625 after platform fees.

For Budget Products (Under ₹300 on Amazon / Under ₹1,000 on Flipkart):

You still pay fulfillment fees, but NO commission!

Platform fees drop to 15-20% instead of 30-38%.

This is a massive advantage if your product fits this price bracket.

Pro tip: Don’t just trust the commission rate mentioned in marketplace guidelines. Actually check your settlement reports. List something at ₹1000, see what you actually receive after all deductions. That’s your real platform fee percentage.

Updated marketplace fee ranges (2026):

- Amazon: 15-20% for products under ₹300, 28-38% for products above ₹300

- Flipkart: 15-22% for products under ₹1,000, 25-35% for products above ₹1,000

- Myntra: 30-40% total fees (fashion categories, no low-price exemptions)

- Meesho: 8-15% total (0% commission + shipping ₹40-90 + optional ads)

This is why you need an amazon price calculator for sellers or flipkart product price calculation tool — manually doing this math for 20-30 SKUs is painful and error-prone.

Step 4: Adjust for Returns (Critical for Fashion and Electronics)

Next major leak: how returns affect marketplace pricing.

In fashion (Myntra, Ajio), return rates can hit 25-35%. On Amazon fashion, typically 15-20%. Electronics can be 10-15%. Meesho is lower, around 5-10%.

Maan lo your historical return rate is 18%.

This means out of 100 orders, 18 come back. You bear the reverse logistics cost, and you don’t earn anything on those 18 orders.

So you need to price such that the 82 orders that stick cover the cost of all 100.

Formula for return adjustment:

Adjusted Price = Previous Price ÷ (1 – Return Rate %)

Adjusted Price = ₹962 ÷ (1 – 0.18)

Adjusted Price = ₹962 ÷ 0.82 = ₹1,173

This is your myntra seller margin calculation or flipkart return cost calculation in action.

Step 5: Adjust for Advertising Costs (TACOS)

If you’re running Amazon Sponsored Products, Flipkart PLA, or Myntra ads, you’re spending 10-20% of revenue on advertising just to stay visible.

This is called TACOS (Total Advertising Cost of Sale) basically, ad cost in marketplace pricing.

Maan lo your TACOS is 12% (pretty standard for competitive categories).

Again, divide upward:

Final Selling Price = Adjusted Price ÷ (1 – TACOS %)

Final Selling Price = ₹1,173 ÷ (1 – 0.12)

Final Selling Price = ₹1,173 ÷ 0.88 = ₹1,333

Round it to ₹1,299 or ₹1,349 depending on pricing psychology and competitor positioning.

The Complete Journey (Reality Check)

Let’s recap the entire marketplace commission calculation flow:

- Market baseline: ₹450

- Your value with USP: ₹625

- After 35% platform fees: ₹962

- After 18% returns: ₹1,173

- After 12% ad costs: ₹1,333

Your final listing price should be ₹1,299 to ₹1,399.

And I know exactly what you’re thinking right now:

“₹1,299 for a kurti that others sell at ₹450? Pagal ho gaye ho kya? Nobody will buy!”

But here’s the uncomfortable truth: if you can’t sell it at ₹1,299-1,399, you genuinely should not be selling that product.

Because anything below that price, and you’re making a loss. You’re literally paying Amazon and Flipkart for the privilege of working for free.

Better to not sell at all than to sell at a loss.

However Important Strategy Note:

If your product CAN be positioned below ₹300 (Amazon) or below ₹1,000 (Flipkart), you get the zero-commission advantage. This completely changes your economics and might make budget pricing viable.

Use a proper marketplace pricing calculator to compare: should you position at ₹299 on Amazon with zero commission, or at ₹1,299 with full commission but premium positioning?

Real Example: How a Seller Lost ₹80,000 in 6 Months Without Realizing

Let me share an actual case that still haunts me.

A seller came to me selling mobile back covers on Amazon and Flipkart. He was doing 400-500 orders monthly. Dashboard looked healthy. He felt he was doing well.

His mental math:

- Product cost: ₹45

- Selling price: ₹149

- Margin per unit (he thought): ₹149 – ₹45 = ₹104

- Monthly profit (he assumed): ₹104 × 450 orders = ₹46,800

Looked great on paper, right?

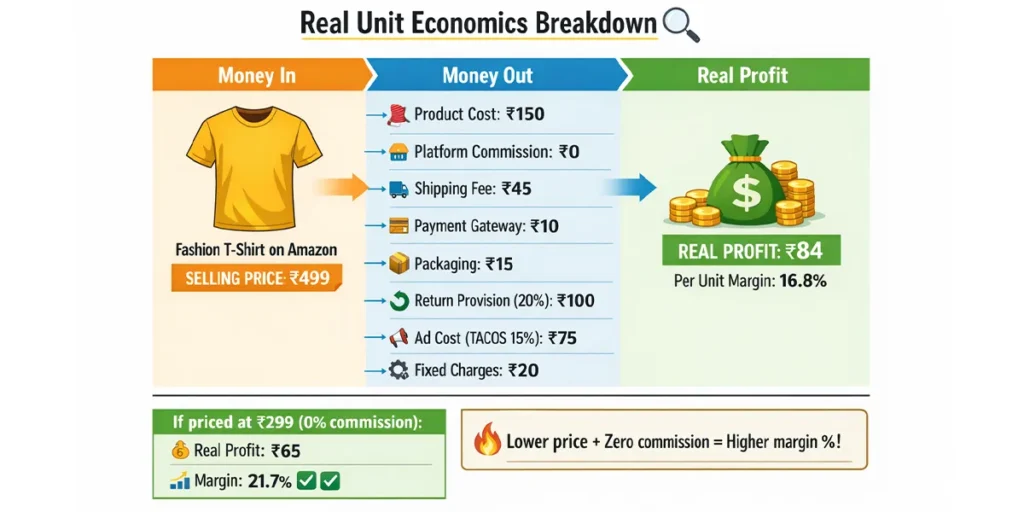

But when we sat down and did actual ecommerce reconciliation report analysis with his settlement data, returns data, and ad spend reports, here’s what we found:

Real Per-Unit Economics:

| Item | Amount |

|---|---|

| Selling Price Listed | ₹149 |

| Platform commission (18%) | -₹27 |

| Fulfillment & logistics | -₹22 |

| Payment gateway (2.5%) | -₹4 |

| Fixed fees | -₹3 |

| Total Platform Deductions (34%) | -₹56 |

| Amount before ads/returns | ₹93 |

| Advertising cost per order (TACOS 18%) | -₹27 |

| Return cost (14% return rate, averaged) | -₹21 |

| Product cost | -₹45 |

| ACTUAL PROFIT PER UNIT | ₹0 |

Zero. Literally zero profit per order.

Some months when return rate spiked to 18-20%, or ad costs went up, he was making a loss of ₹8-12 per order.

Monthly reality: 450 orders × ₹0 average = ₹0 profit

In bad months: 450 orders × (-₹10) = ₹4,500 loss

This seller had been running for 6 months thinking he was profitable. Over those 6 months, he’d actually lost close to ₹80,000 when you factored in inventory blocking, working capital cost, and actual losses in high-return months.

He was working 12-hour days to make zero money.

What did we fix?

We used a proper meesho seller price calculator type tool (he’d also listed on Meesho by then), recalculated his pricing:

- New selling price on Amazon: ₹249

- New selling price on Flipkart: ₹239

- Shifted some SKUs to Meesho where 0% commission made ₹149 price point viable

- Stopped running ads on low-margin SKUs

- Focused only on designs with sub-10% return rates

Within 2 months, his per-unit profit went from ₹0 to ₹38-42.

Yes, his order volume dropped from 450 to about 280 monthly on Amazon/Flipkart. But he added 150 orders on Meesho. His actual profit went from ₹0 to ₹12,500+ per month across all platforms.

He was finally making money.

That’s the power of real unit economics of amazon sellers not vanity metrics, actual profit.

Why Marketplace Reconciliation Is Non-Negotiable (This Saves Lakhs)

Now let me talk about something most sellers completely ignore: marketplace reconciliation process.

Reconciliation means matching your marketplace dashboards with your actual bank statements, returns data, ad spends, and other costs to find out what’s really happening.

Why Your Dashboard Is Lying to You

Your Amazon Seller Central shows “sales”. But sales ≠ profit. Not even close.

Your Flipkart Seller Hub shows “orders placed”. But orders ≠ money in your account.

Why the gap?

Because:

- Returns happen 5-7 days after delivery (sometimes 15 days later)

- Chargebacks and penalties appear weeks later

- Ad spends are billed separately from order settlements

- TCS deductions happen at source

- GST input credit mismatches create phantom costs

- RTO charges hit you later

So if you’re only looking at your “orders” tab or “sales” number, you’re looking at a beautiful lie.

What Proper Reconciliation Shows You

When you do ecommerce reconciliation report properly, you discover:

- Real profit per SKU which products actually make money vs which are bleeding cash

- Exact loss reasons is it returns? ads? platform fees? wrong pricing?

- Leakage points by category maybe fashion has 28% returns but home decor has only 8%

- Marketplace comparison maybe you’re profitable on Flipkart but losing on Amazon for the same SKU

- Month-on-month trends are returns increasing? is TACOS climbing?

Once you have this data, you can make real decisions:

- Stop selling SKUs that lose money (yes, actually stop don’t be emotional)

- Increase prices on profitable SKUs where you have room

- Cut ad spend on products with 25%+ TACOS

- Negotiate harder with suppliers on high-volume, low-margin items

- Switch marketplaces for certain categories (maybe Meesho for budget, Myntra for premium)

How to Do Basic Reconciliation (Simple Monthly Process)

You don’t need expensive software to start. Here’s the basic process:

Step 1: Download settlement reports from Amazon/Flipkart/Meesho for the month

Step 2: Download return reports (RTO + customer returns)

Step 3: Download ad spend reports from advertising consoles

Step 4: Match total orders with actual bank credits

Step 5: Calculate per-order profit: (Bank Credit + Ad Spend + Return Losses) ÷ Total Orders

Do this every month. Takes 2-3 hours initially, then 1 hour once you get the hang of it.

Or if you’re doing 1000+ orders monthly, use a reconciliation tool. But either way, you must reconcile. Non-negotiable.

This single practice will save you lakhs over a year. I’ve seen it happen dozens of times.

Marketplace-Wise Pricing Reality (Quick Guide – Updated 2026)

Each marketplace has its own madness. Let me give you a quick reality check for each:

Amazon India: Complex Fee Structure, But Zero Commission Below ₹300

2026 Update: Amazon eliminated referral fees on products under ₹300 (extended policy till Dec 2025, likely to continue).

Challenges:

- Platform fees: 15-20% for products under ₹300, 28-38% for products above ₹300

- Advertising is almost mandatory: You need 12-18% TACOS to stay on page 1

- Returns processed fast: Good for customers, brutal for sellers

- Fee structure is complicated: Weight slabs, size tiers, category variations

Strategic advantage:

If you can position your product under ₹300, you save 15-20% in commission. This makes budget products far more viable than before.

What you need:

A proper amazon price calculator for sellers that includes:

- Category-wise commission

- Zero-commission threshold (under ₹300)

- Weight-based fulfillment fees

- Returns estimation by category

- TACOS calculation

- Final per-unit profit

Without this, you’re just guessing what price to list.

Flipkart: Zero Commission Below ₹1,000 (Game Changer)

2026 Update: Flipkart launched 0% commission on products under ₹1,000 in November 2025.

Challenges:

- Platform fees: 15-22% for products under ₹1,000, 25-35% for products above ₹1,000

- Return rates can spike during sales (BBD, Diwali sales)

- Payment cycles slightly longer than Amazon (but improving)

- Flipkart Ads (PLA) costs: 10-15% TACOS needed for visibility

Strategic advantage:

The ₹1,000 threshold is HUGE. Most mid-range products can benefit. If you’re currently pricing at ₹1,200, consider repositioning at ₹999 to capture the zero-commission benefit.

What you need:

Flipkart product price calculation tool that factors in:

- Commission by category

- Zero-commission threshold (under ₹1,000)

- Return patterns (check your own data, it varies)

- Ad spend reality

- Actual settlement timelines

Don’t assume Flipkart pricing = Amazon pricing. Test and track separately.

Meesho: True 0% Commission Model (But Shipping Costs Matter)

2026 Reality: Meesho charges 0% commission across ALL categories (verified).

However, the catch:

- Shipping fees: ₹40-90 per order (weight and distance based) + 18% GST

- Optional advertising: Recently introduced, 5-10% if you use it

- Total effective cost: 8-15% (shipping + ads if used)

Challenges:

- Customer expectations: Products at ₹99, ₹149, ₹199, ₹299 ultra-competitive price points

- Margins are still tight: Even with 0% commission, low prices mean you need volume

- Returns lower (5-10%) but quality expectations are different

- Tier 2/3 customer base: Different from Amazon/Flipkart premium buyers

What you need:

A meesho seller price calculator to see:

- Can you actually survive at ₹149-₹299 price points even with 0% commission?

- What does shipping cost per unit in your weight category?

- What volume do you need to hit ₹50k profit monthly?

- Is your product category even suitable for Meesho’s customer base?

Many sellers try Meesho thinking “0% commission = guaranteed profit” and then realize shipping costs + low prices still create thin margins. Do the math first.

Strategic advantage:

For lightweight products (under 500g) at ₹149-₹499, Meesho can be highly profitable due to 0% commission and lower shipping costs.

Myntra: Fashion-Focused, Return Rates Will Shock You

Challenges:

- Very high platform fees: 30-40% in fashion categories

- Return rates are insane: 25-35% in some categories (ethnic wear, western wear)

- Customer expectations: Premium packaging, fast delivery, perfect fit, size variety

- Ad costs matter: Categories are crowded, you need 12-20% TACOS for visibility

- One-time seller fee: ₹10,000-25,000 Growth Enablement Fee when you start

What you need:

Myntra pricing calculator that honestly factors in:

- 30-40% platform fees

- 25-35% return rate reality (check your category data)

- 12-20% TACOS

- Premium packaging costs (better boxes, tags, tissue paper expected)

If you’re not pricing at 2.5-3x your product cost on Myntra, you’re likely losing money.

Strategic reality:

Myntra is NOT for budget fashion. You need premium positioning, excellent photography, and strong branding. Otherwise, the high fees and returns will kill you.

Quick Comparison Table (2026 Updated)

| Factor | Amazon | Flipkart | Meesho | Myntra |

|---|---|---|---|---|

| Commission | 0% under ₹300, then 5-25% | 0% under ₹1,000, then 4.5-25% | 0% all products | 15-40% |

| Total Platform Fees | 15-20% (under ₹300), 28-38% (above) | 15-22% (under ₹1,000), 25-35% (above) | 8-15% (shipping + ads) | 30-40% |

| Ad Dependency | High (12-18%) | Medium (10-15%) | Low (0-5%) | Medium-High (12-20%) |

| Return Rates | 15-20% | 15-22% | 5-10% | 25-35% |

| Best Price Range | ₹300-₹3,000 | ₹200-₹2,000 | ₹99-₹499 | ₹599-₹3,999 |

| Best For | Mid-premium products | Value products | Budget volume play | Fashion brands |

Common thread across all marketplaces:

Hidden costs everywhere. And if you’re not using proper marketplace pricing calculator logic, you’re pricing yourself into losses.

Why Every Seller Needs a Pricing Calculator (Not Just Excel Guesswork)

Let’s be honest: doing all this math manually for every SKU is painful and error-prone.

You need to factor in:

- Platform commission (now varies by price threshold!)

- Fulfillment fees (weight and size-based)

- Fixed platform charges

- Payment gateway fees (except Meesho)

- Returns (% based on your historical data or category average)

- Ad costs (your actual TACOS)

- GST and TCS complications

Then you need to reverse-calculate the selling price that gives you your target 15-20% net margin.

This is where a proper marketplace pricing calculator becomes essential — not optional.

What a Good Pricing Calculator Should Do (2026 Edition)

Whether it’s an amazon price calculator for sellers, flipkart product price calculation tool, or myntra seller margin calculation spreadsheet, it should:

- Let you input your product cost

- Let you set your target profit margin (15-20% minimum)

- Auto-detect zero-commission thresholds (₹300 for Amazon, ₹1,000 for Flipkart)

- Auto-pull platform fees based on category and marketplace

- Include returns based on category benchmarks or your data

- Factor in your average TACOS

- Account for packaging, shipping to warehouse, other variable costs

- Show you the exact listing price you need

- Show you final unit economics — profit per order after everything

- Compare across marketplaces — show you where each SKU is most profitable

Without this calculator, you’re flying blind. You’re just picking a number that “feels right” and hoping for the best.

Common Manual Calculation Mistakes That Kill Profits

I’ve personally seen sellers make these errors repeatedly:

Mistake 1: Subtracting platform fee % instead of dividing

Wrong: ₹500 – 35% = ₹325

Right: ₹500 ÷ 0.65 = ₹769

Impact: Massive underpricing, guaranteed losses

Mistake 2: Forgetting payment gateway fees (2-3%)

Impact: ₹6-9 per order just vanishes

Mistake 3: Not factoring returns into price calculation

Impact: 15-35% of revenue just disappears, no buffer in pricing

Mistake 4: Ignoring ad costs because “woh alag hai”

Impact: Another 10-20% gone, pricing doesn’t account for it

Mistake 5: Calculating commission on cost instead of selling price

Impact: Fundamental math error, completely wrong pricing

Mistake 6: Missing the zero-commission thresholds (NEW!)

Impact: Pricing at ₹350 when ₹299 would save 15% in fees, or at ₹1,200 when ₹999 would be far more profitable

Just ONE of these mistakes, and your entire pricing is off. You think you’re making ₹60 per unit, reality is you’re losing ₹15.

That’s why even experienced sellers use a unit economics calculator to double-check their math before listing.

Strategic Pricing Decisions for 2026 (Zero-Commission Era)

The Amazon and Flipkart zero-commission policies create completely new strategic questions:

Question 1: Should I Price Below or Above the Threshold?

Example: Your unit economics say you need ₹350 to be profitable.

Option A: Price at ₹349 on Amazon

- Get 0% commission benefit

- Save ₹50-60 per order in fees

- But lower perceived value

Option B: Price at ₹449 on Amazon

- Pay full commission (₹80-90)

- Higher perceived value

- Better margins IF customers still buy

Use your amazon price calculator for sellers to model both scenarios. Sometimes the threshold creates a “sweet spot” where slightly lower pricing is dramatically more profitable.

Question 2: Should I Use Different Prices on Different Marketplaces?

Absolutely yes.

Your ₹999 price on Flipkart (0% commission) might be perfect.

The same product might need ₹1,199 on Amazon (full commission).

And ₹899 on Myntra might still lose money due to returns.

This is why marketplace reconciliation and separate pricing strategies per platform are critical.

Question 3: Can Budget Products Be Profitable Now?

Yes if positioned correctly.

Products that were impossible to sell profitably at ₹199 on Amazon in 2024 (due to commission eating everything) can now work at ₹249-₹299 in 2026 (zero commission).

Similarly, Meesho’s 0% commission makes ₹149-₹249 price points viable for lightweight products.

The key is using a proper marketplace pricing calculator to verify the math before committing inventory.

The Final Word: Stop Gambling, Start Calculating

Let me close with the single most important thing I’ve learned working with 1000+ sellers over 15 years:

Pricing based on gut feeling is gambling. Pricing based on unit economics is business.

And gambling always loses in the long run.

Stop looking at competitor prices and thinking, “I need to match them or go lower.”

Stop adding random 30-40% margin to your cost and calling it a day.

Stop celebrating “100 orders today!” without knowing if those orders made you money or drained your account.

Instead, do this:

Your Action Plan (Start This Week)

Week 1:

- Pick your top 5 SKUs by volume

- Calculate actual profit calculation per order ecommerce for each:

Selling Price – (All Platform Fees + Returns + Ads + Product Cost) = ? - Be brutally honest with the numbers

- Check if any SKUs should be repositioned below ₹300 (Amazon) or ₹1,000 (Flipkart)

Week 2:

- Do marketplace reconciliation for last month:

- Download all settlement reports

- Match with bank credits

- Include returns and ad spends

- Find your real profit (or loss)

Week 3:

- Use a proper marketplace pricing calculator (build one in Google Sheets or use a tool)

- Recalculate selling prices for all active SKUs

- Model different scenarios: Below threshold vs. above threshold

- Decide: which SKUs to reprice, which to stop selling, which to move to different marketplaces

Week 4:

- Implement new prices

- Set up monthly reconciliation as a non-negotiable process

- Track unit economics weekly

- Test Meesho for budget products (0% commission advantage)

Yes, you might lose some volume when you increase prices. That’s fine.

Better to do 200 profitable orders than 500 loss-making orders.

The Truth About Pricing Higher

Look, I get the fear. Pricing at ₹799 when competitors are at ₹499 feels scary.

But here’s what actually happens when you price correctly:

Scenario 1: You price low (₹499)

- Get 100 orders

- Make ₹5 profit per order (or lose ₹10)

- Total profit: ₹500 (or -₹1,000 loss)

- You’re exhausted, working hard, going broke

Scenario 2: You price right (₹799)

- Get 60 orders (volume drops)

- Make ₹85 profit per order

- Total profit: ₹5,100

- You’re relaxed, sustainable, actually building a business

Which scenario would you prefer?

Customers buy value, not just the lowest price. If your product photos are good, your listing is clear, you have decent reviews, and your delivery is fast — people will pay ₹799 even when someone else sells at ₹499.

Why? Because they trust you. Because your quality signals are better. Because the perceived value justifies the price.

But if you price at ₹499 when your real unit economics of amazon sellers says you need ₹799, you’ll win the sale and lose your business.

Don’t be that seller.

One Last Reality Check

I’m going to be very direct here because I genuinely care about seller success:

If your unit economics for ecommerce sellers don’t work, you don’t have a business. You have an expensive hobby that’s draining your savings.

And no amount of “working harder” or “getting more orders” will fix broken unit economics.

Fix the math first. Then scale.

Price based on data. Use a marketplace pricing calculator. Do monthly ecommerce reconciliation reports. Know your profit per order for every single SKU.

Take advantage of the zero-commission policies where they make sense. But don’t assume zero commission = automatic profit. You still have shipping, returns, ads, and all other costs.

This is how real brands survive. This is how profitable sellers operate.

Not on hope. Not on “chalta hai” attitude. On actual numbers.

Ready to stop losing money?Open your settlement report right now. Pick one SKU. Calculate the real profit. Include everything platform fees, returns, ads, all of it.

Then check: Could this SKU be repositioned below ₹300 (Amazon) or ₹1,000 (Flipkart) to save on commission? Or should it be moved to Meesho where 0% commission might make it viable?

If the numbers scare you, good. That’s reality hitting you. Now you can actually fix it.

Stop pricing on assumptions and competitor-copying.

Start pricing on marketplace unit economics.

Your business will finally start making sense. And your bank balance will reflect it.